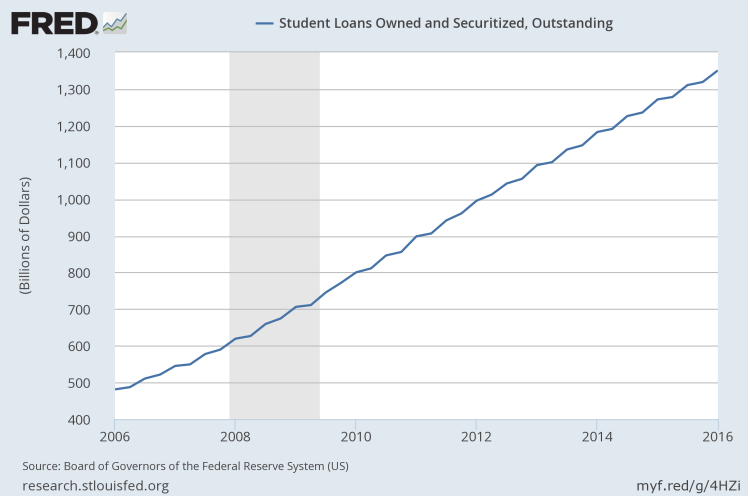

Over the past decade student loan debt has grown to over $1.2 trillion. The rise in the overall student loan balance is partially due to the surge in attendance at American universities. The number of people age 19-24 attending a university rose almost 40% between 2000 and 2015. During the same time, tuition at four-year public universities rose 3.4% annually. These two factors have caused the amount of debt among younger americans to skyrocket.

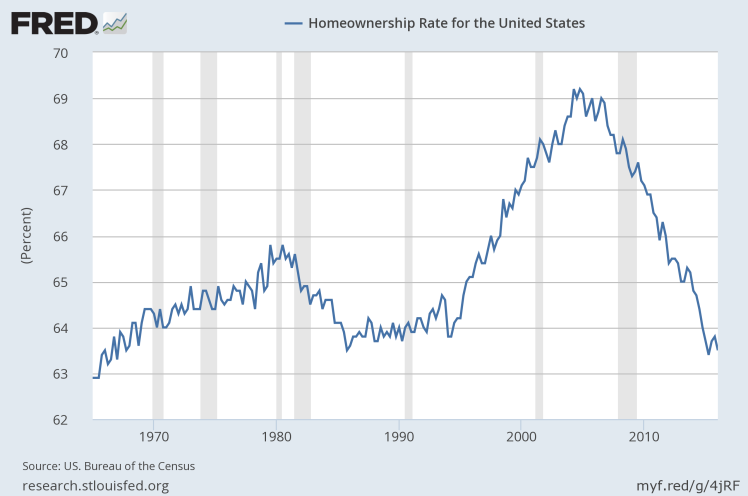

The indebtedness of millennials is having an impact on the housing market. Homeownership rates have declined rapidly for individuals under 35. The drop is even more steep among students who are currently paying off loans. A paper published by the Federal Reserve Bank of Boston showed that “young debtors were less likely to own a home than their debt free peers.” Ownership rates start to steadily grow as individuals reach their mid to late twenty’s. Student loan debt seems to delay, if not entirely deter, the willingness of young people to buy homes.

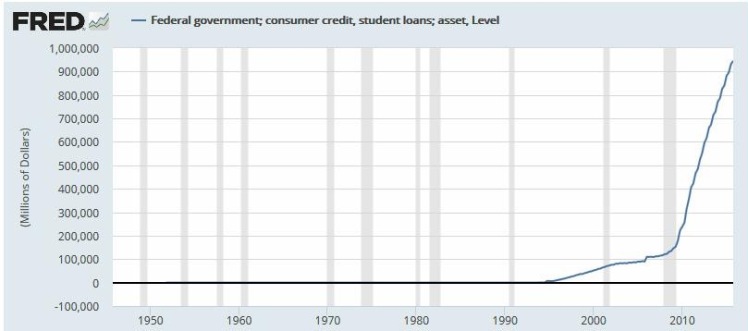

Much like the housing bubble of the 2000’s, the rise in student loan debt is due partly to the government’s effort to make getting a loan easier. Although this might seem like a proactive initiative, it has brought to light far too familiar risk. The expanded access to student loans creates a massive amount of debt to future members of the workforce. In 2015, nearly 7 out of 10 college graduates had student loan debt. The total amount of student loan debt is more than credit card and auto loans combined. Amazingly, student loans make up 45% of federally owned financial assets. Moreover, the return on investment of a college education is slowly declining. This is due in part to a sluggish economy that is quickly changing.

At its core, higher education is about security and insurance against the future. It is far too easy to get caught up in the idea of furthering your education and forget that it is possibly one of the biggest financial risk an individual will take. An excessive feeling of security in higher education could turn out to be a blind spot in the minds of students and society as a whole.